When Can Contribute To Roth Ira 2025. Magi must be under $240,000 for tax year 2025. In 2025, the threshold rises to $161,000.

Key takeaways the combined annual contribution limit for roth and traditional iras for the 2025 tax year is $7,000, or $8,000 if you’re age 50 or older. Magi must be under $240,000 for tax year 2025.

How Much Can I Contribute To Roth Ira 2025 Jenni Leanna, That means you can make a contribution to a roth ira for tax year 2025 until april 15, 2025. The roth ira contribution window for 2025 opens on jan.

Roth IRA contribution limits aving to Invest, In 2025, the threshold rises to $161,000. Ira contribution limits for 2025.

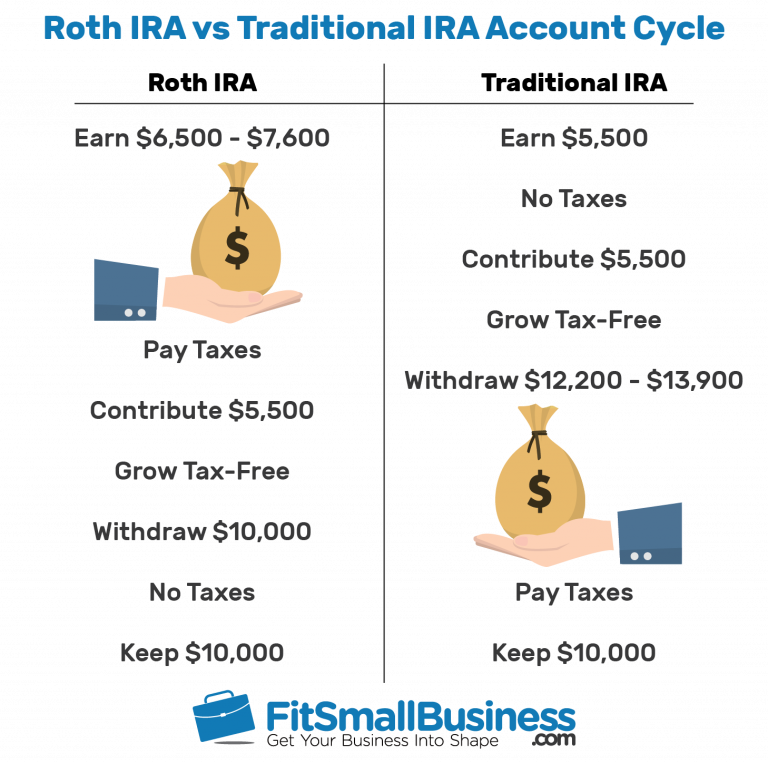

Roth IRA Rules, Contribution Limits & Deadlines Best Practice in HR, Additionally, you can only contribute up to the annual roth ira limit every year, which is. Ira contribution limits for 2025.

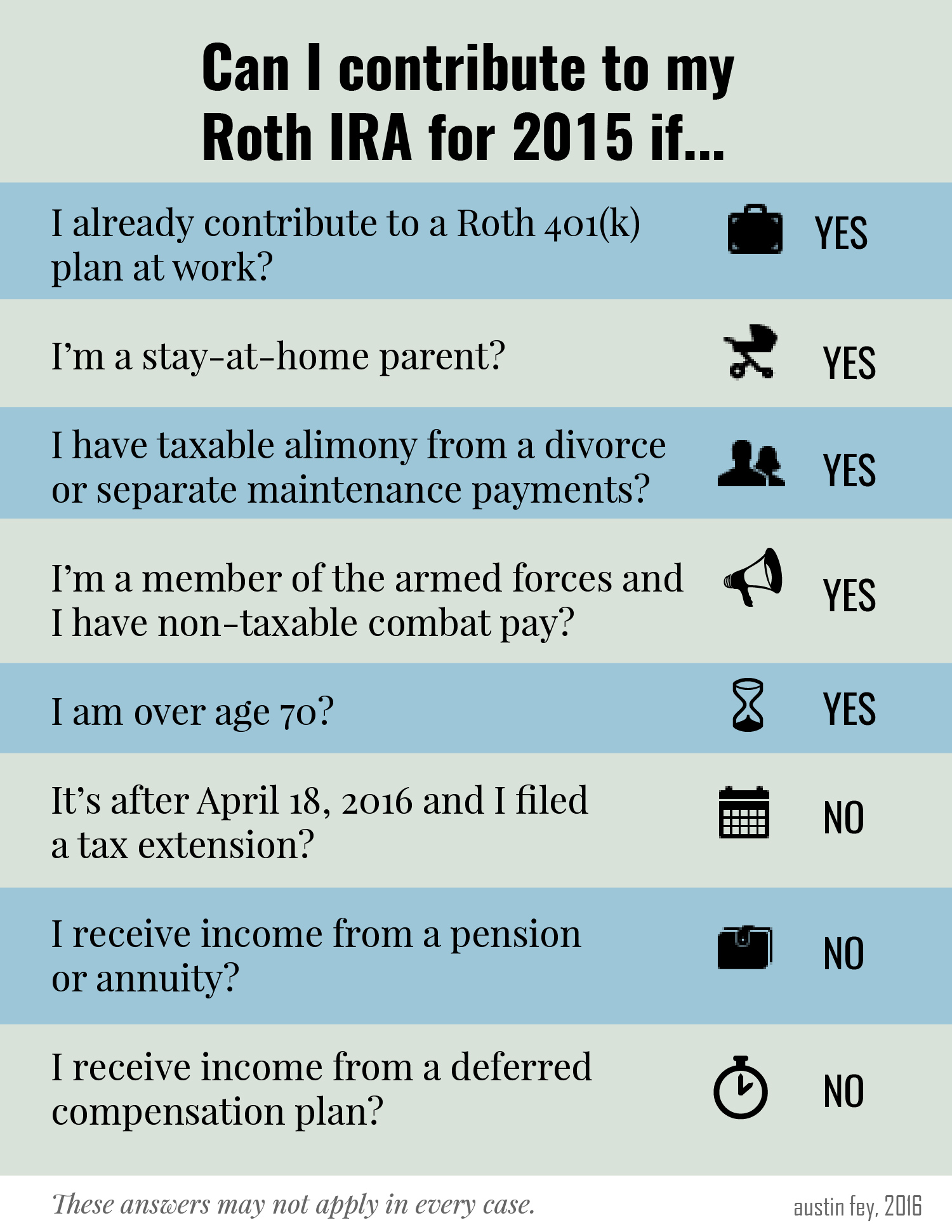

Can I Contribute to my Roth IRA? Marotta On Money, The roth ira contribution limits increased in 2025 and are moving up again in 2025. Those limits reflect an increase of $500.

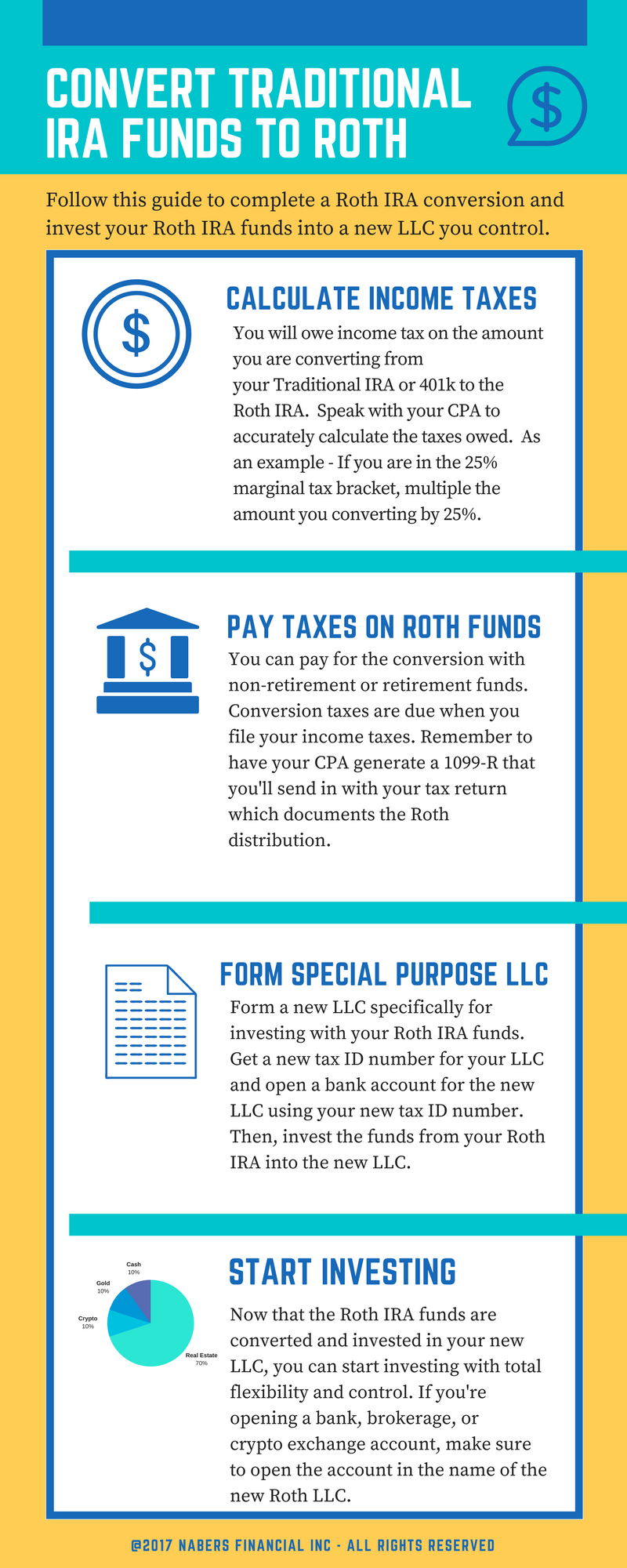

Roth IRA Contribution and Limits 2025/2025 TIME Stamped, You can't directly convert your rmds to a roth. What you need to know about roth iras here’s the thing about opening a roth ira:.

What is a Roth IRA? The Fancy Accountant, If you don’t qualify to make a deductible contribution, you can still put money in a traditional ira. You can make contributions to your roth ira after you reach age 70 ½.

Roth IRA Who Can Contribute? The TurboTax Blog, Key takeaways the combined annual contribution limit for roth and traditional iras for the 2025 tax year is $7,000, or $8,000 if you're age 50 or older. You can convert up to $35,000 from a 529 savings plan to a roth ira.

How to Convert Traditional IRA Funds to Roth Solo 401k, To contribute to a roth ira, single tax filers must have a modified adjusted gross income (magi) of less than $153,000 in 2025. That's up from $138,000 in.

IRA Contribution Limits in 2025 Meld Financial, You can't directly convert your rmds to a roth. Whether you can contribute the full amount to a roth ira depends on your income.

Roth IRA Limits And Maximum Contribution For 2025, But for some people, there is a potential workaround. The roth ira contribution window for 2025 opens on jan.